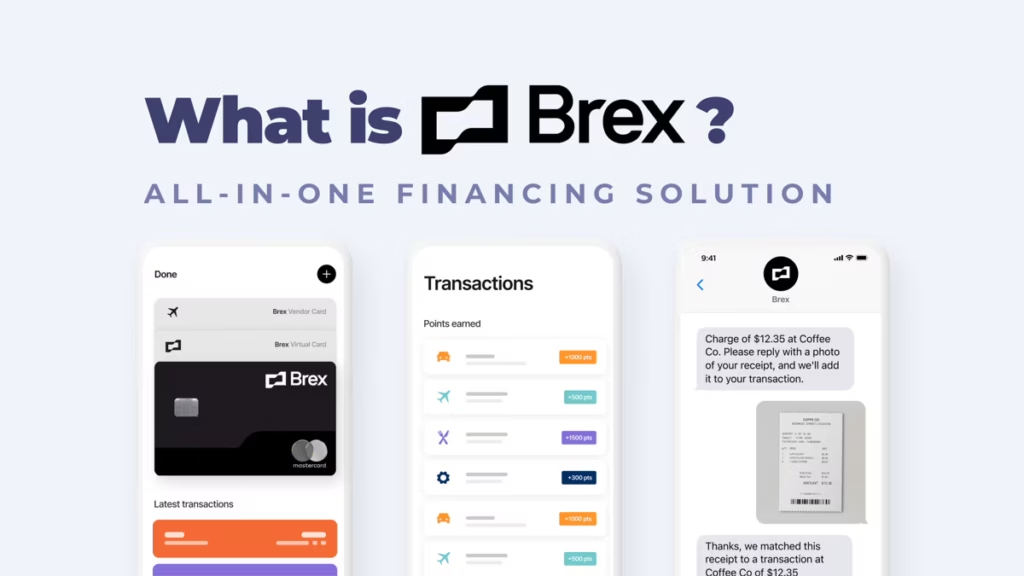

In the fast-paced world of startups, one thing is certain: managing finances efficiently is crucial for success. But with traditional banks and financial institutions often burdening businesses with complicated processes and endless paperwork, how can startups thrive? Enter Brex—a fintech startup that’s reshaping the way companies handle their finances. Brex offers a suite of powerful tools designed to make managing business expenses faster, easier, and more flexible. In this article, we’ll dive into why Brex is a must-know startup and how it’s helping businesses scale effortlessly.

What is Brex?

Founded in 2017, Brex is a fintech powerhouse based in San Francisco, built to serve the unique financial needs of startups and growing businesses. Unlike traditional banks, Brex offers business credit cards, expense management tools, and other digital financial services that simplify the way companies access capital and manage their spending. With Brex, businesses can streamline their financial operations, save time, and scale quickly—all without the red tape associated with traditional banking.

Why Every Startup Should Know About Brex

- Fast, Flexible Access to Capital

For many startups, accessing funds can feel like navigating a maze. Traditional banks often require long applications, personal guarantees, and tedious paperwork. Brex changes the game by offering business credit cards with no personal guarantee, meaning entrepreneurs can access the funds they need quickly and easily. No more waiting around for approvals—Brex gives businesses the financial flexibility they deserve.

- Simplified Financial Management

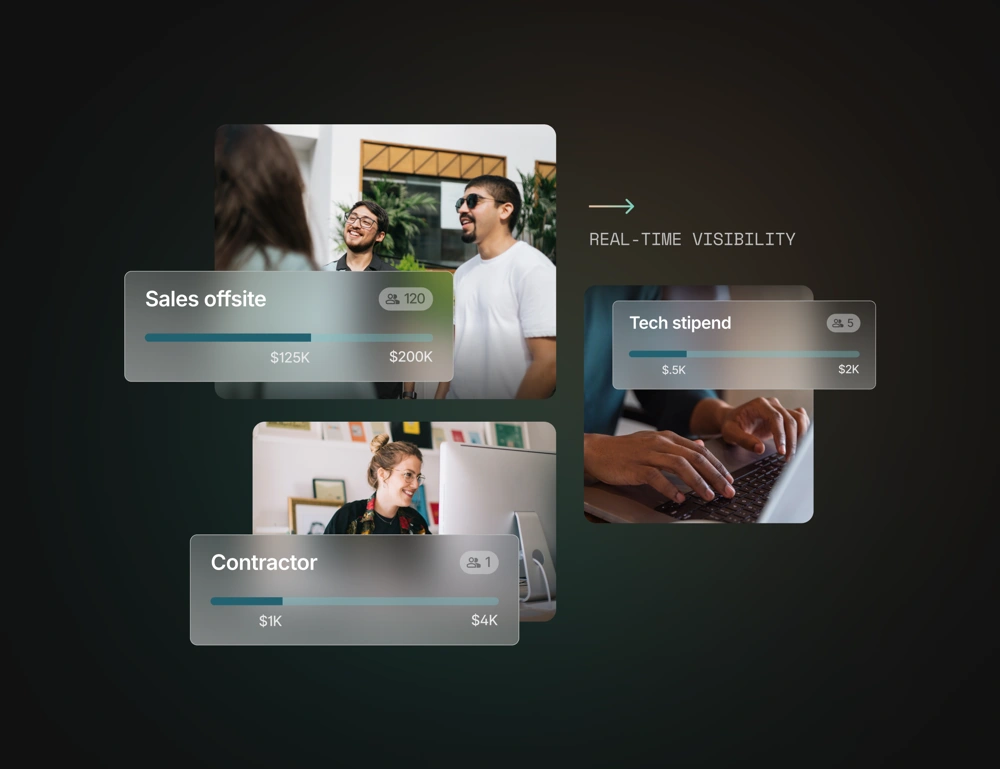

Managing startup finances can quickly become overwhelming, especially when you’re juggling multiple responsibilities. That’s why Brex offers powerful tools to automatically track expenses and manage budgets in real-time. Integration with popular platforms like QuickBooks and Xero means your accounting is seamless, leaving you with more time to focus on growing your business.

- Tailored Financial Solutions for Startups

Brex understands that startups have unique financial needs. That’s why they offer flexible solutions designed specifically for emerging businesses. Whether you’re looking for a business credit card or need a smarter way to manage cash flow, Brex’s tools are built to scale with your business.

- Transparent Pricing, No Hidden Fees

No one likes surprises—especially when it comes to money. Brex offers clear, transparent pricing with no hidden fees, annual charges, or international transaction costs. This straightforward approach makes it easier for startups to budget, plan, and grow their businesses with confidence.

Innovative Brex Products That Help Startups Grow

- Brex Business Credit Cards

Brex’s business credit cards are more than just a way to pay for things—they come with benefits like cashback and rewards for specific categories of spending. These cards make it easy to keep personal and business expenses separate, providing clarity and control over your company’s finances.

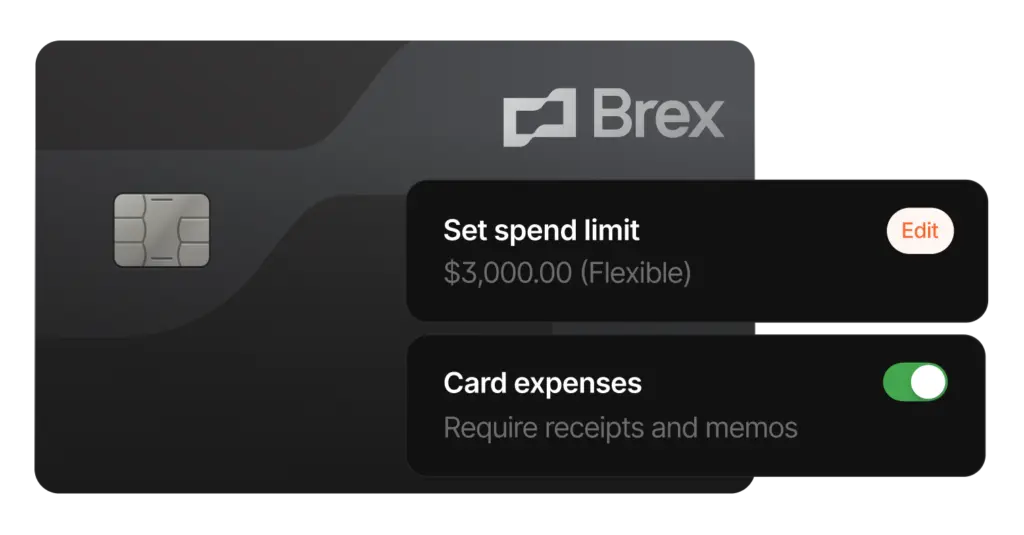

- Spending Control for Teams

If your startup has a team, managing spending can be a headache. With Brex’s team spending controls, business owners can assign cards to team members, set spending limits, and monitor transactions in real-time. This feature keeps spending under control while empowering your team to make purchases as needed.

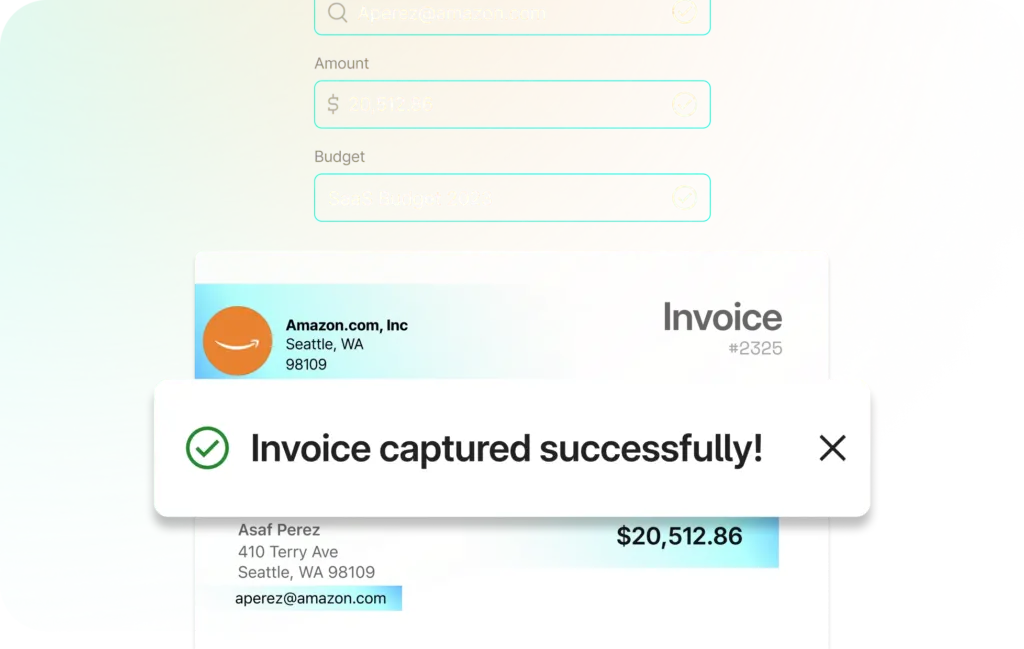

- Automated Financial Recordkeeping

Say goodbye to tedious manual bookkeeping. Brex automatically tracks every transaction made with a Brex card, organizing your financial records for easy access. This saves you time and ensures your accounting is accurate, helping you stay on top of your finances effortlessly.

Why Startups Are Ditching Traditional Banks for Brex

- Speed and Simplicity

Traditional banks often require lengthy paperwork and complex approval processes. Brex, on the other hand, offers a fast, hassle-free application process, giving startups quicker access to credit. Their decision-making is based on company data, not personal credit scores, meaning less red tape and more flexibility for your business.

- More Flexibility

Brex offers startups the freedom to access larger amounts of funding quickly and easily, without the stringent requirements that often come with traditional bank loans. This flexibility allows businesses to seize opportunities without being bogged down by bureaucracy.

- No Personal Guarantee Required

Unlike many banks that demand a personal guarantee from business owners, Brex doesn’t require one to apply for a business credit card. This lowers the risk for entrepreneurs, allowing them to focus on scaling their business instead of worrying about personal liabilities.

Startups Already Trusting Brex

Brex isn’t just a solution for small businesses—top startups like Airbnb, Rappi, and Gusto are already using Brex to manage their finances. These successful companies demonstrate how Brex can fuel growth by providing the financial tools needed to scale quickly and efficiently.

Why Brex is a Startup You Can’t Afford to Ignore

Brex is changing the way startups manage their finances, making it easier, faster, and more flexible than ever before. With innovative products like business credit cards, expense management tools, and automated recordkeeping, Brex is the ultimate financial partner for any startup looking to scale quickly and efficiently. If you’re looking to streamline your finances and focus on growing your business, Brex is a must-have solution for your startup toolkit.

Call to Action:

Ready to take your startup’s financial management to the next level? Sign up for Brex today and experience how easy managing your business finances can be!